The Winter Economy Plan has been announced! James Powell, from HBXL’s network partners, Comera Professional, runs through the Statement from the Chancellor on Thursday 24 September 2020. He explains the key points for small to medium sized building firms.

NEW JOB SUPPORT SCHEME

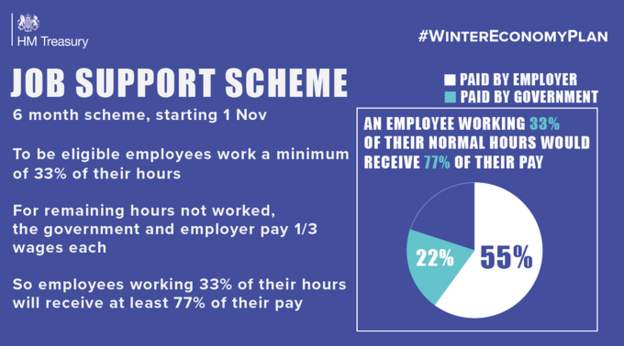

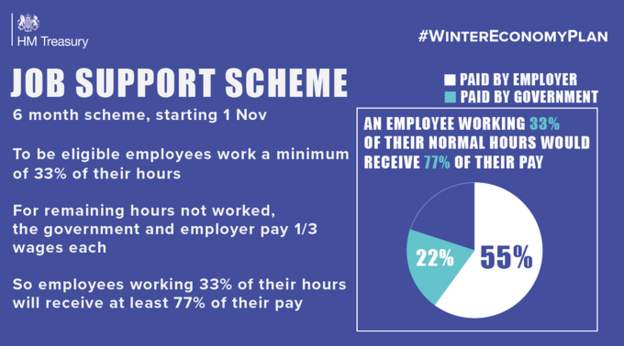

Firstly, the furlough scheme is not being extended, though there wasn’t much chance of this happening in the first place. It is being replaced, though, by something called the ‘jobs support scheme.’ The plan is that if a business keeps an employee on to work at least 1/3 of their normal hours, and pays them for those hours, the government will pay 1/3 of their wages, and the employer the remaining 1/3 of their wages. So if an employee working 33% of their hours would receive at least 77% of their pay. So it’s similar to furlough except employees will be working reduced hours, rather than staying at home.

The BBC News team has provided this example:

If an employee works reduced hours the employer pays for that. And in addition, the employer and government pay one-third of the lost pay each (up to the cap).

So for someone on £2,000 a month working half their hours, they’d get £1,000 normal pay plus £333 extra from their employer and £333 from the government.

The employer can also claim the job retention bonus – as long as they qualify for that.

(If you would like another way of making sense of the new scheme… go to the bottom of the page!*)

The new Job Support Scheme will be open to all small and medium businesses, whether or not you used the furlough scheme. At the moment it’s going to run for 6 months starting from November, and companies who use it will still be able to claim the £1,000 jobs retention bonus providing they fulfil the existing criteria.

The existing grant for self-employed people is being extended on similar terms to the Jobs Support Scheme.

LOANS – APPLICATION EXTENSIONS

You now have until 30 November to apply for a Coronavirus Business Interruption Loan scheme, Future Fund Scheme or Bounce Back Loan so there’s still time to benefit from government-backed support.

LOANS – EXTENDED PAYMENT TERMS

And if you borrowed under the Bounce Back Loan Scheme or the Coronavirus Business Interruption Loan, the Chancellor is offering the option of more time and greater flexibility for their repayments. It’s called ‘Pay as you grow’.

So loans can now be extended to ten years nearly halving the average monthly repayment.

You can also move to interest only payments (or suspend payments if in really difficulty) for up to six months. Your credit rating will not be affected.

There will also be a new loan scheme in January which the Treasury is currently developing.

VAT AND INCOME TAX REPAYMENTS – LONGER REPAYMENT

Lastly, if you deferred your VAT and/or income tax payment you will be allowed to repay over 11 months with no interest being charged, rather than having to put up all the cash in January/March.

We’ll keep you posted on any further details, as they emerge.

*Another BBC correspondent’s take on the Job Support Scheme:

The maths in the new Job Support Scheme are not especially easy to grasp.

So a helpful way to think about it is the overall percentage of a person’s salary that the government can end up paying for.

For someone who works a third of their standard hours, the government’s contribution would be two-ninths – or approximately 22% (compared with 80% at the beginning of the furlough).

The employer would pay the first third, like normal, and another two-ninths on top. The employee would get nearly 78% of their salary.

The 22% government contribution is a maximum. For someone working 50% of hours, the government contribution is 17%. It’s a sliding scale.

Joanna Mulgrew

Author